Falcon® AEPS Machine - Aadhaar Enabled Payment System Micro-ATM

The Falcon® AEPS machine (Aadhaar Enabled Payment System Machine) also known as Micro-Atm for AEPS offers a reliable way to meet today’s demand for secure, cashless transactions. It allows businesses to perform essential banking functions such as cash withdrawals, balance inquiries, and Aadhaar-to-Aadhaar fund transfers, all with ease. Its user-friendly design ensures that even non-technical users can navigate its features effortlessly, making it a practical addition to retail stores, service points, and mobile units. The device’s compact build enables easy placement on countertops or portable use, catering to a variety of operational needs.

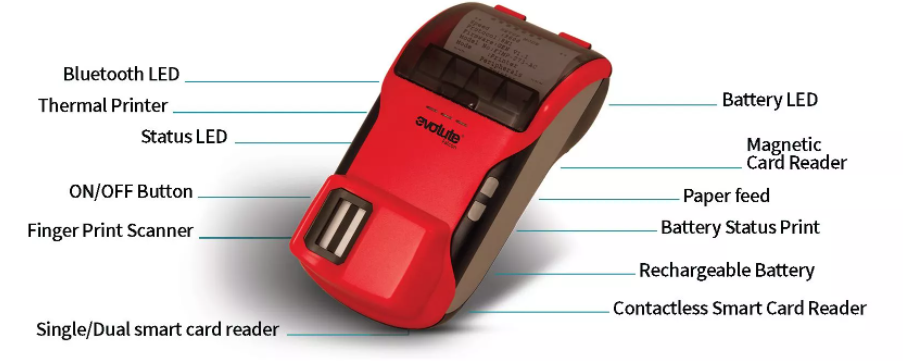

Falcon® AEPS machine is a smart, portable device that enables your existing smart devices like mobile phone, tablet, laptops to serve as a micro ATM for providing financial services. With its durability & rugged features, it performs well even in the harshest of the environments. It can deliver a variety of services such as e-kYC, cash withdrawals, cash deposits, cash transfers and retail payments as available under the Aadhaar-enabled transactions ambit and backs this with a receipt via the Thermal Printer. It comes with capabilities such a fingerprint scanner, single or dual smart card reader, three-track magnetic card reader, contactless smart card reader, and security access module as options.

ACCELERATE BUSINESS: Identification | Authentication | Authorization

Innovative & Fast

Falcon® is an innovative affordable alternative to render last mile doorstep banking and financial services.

Advanced Technology

Falcon® combines several technologies like high speed thermal printing, biometric finger print scanner, smart card reader in addition with a long lasting battery.

Loan Management System

A single Aeps machine helps in your complete loan management process. This includes KYC verification at the onboarding stage. Post this the same device can be used during the Disbursement by again using the biometrics for authentication or collect the loan by again authenticating the same via biometrics.

Each step over here is backed with a receipt generated from the Falcon® that can be shared with the customers as a proof of the transaction.

Please note for these steps a relevant Loan Management application needs to be integrated with Falcon® to give a quick and a seamless experience.

Similar to loan management there are a multiple use-cases under that can help the banks and financial institutions to carry out such transactions with ease.

Supported by Prowess SDK

Applications of Falcon® AEPS Machine (Micro-ATM)

Utility Payments

Agency banking/Branchless Banking

Non-Banking Financial Corporations

eGovernance

Identity Management

Telecom

Microfinance

Parking Solutions

Top Features of the Falcon® AEPS Machine: All-In-One Micro ATM with Biometric Capabilities

Thermal Printer Technology: The Falcon® AEPS machine features a high-quality thermal printer for fast, clear, and smudge-free receipt printing, adding professionalism to every transaction.

Extensive Card Compatibility: The Falcon® AEPS machine supports all major debit cards, with only a few exceptions for cooperative bank cards, making it versatile for a broad range of customers.

Instant Payment Receipts: After completing transactions, the AEPS machine produces a receipt that can be printed with the inbuilt printer or shared digitally with customers, ensuring easy record-keeping and enhanced service.

Multi-Payment Support: The Falcon® AEPS machine accepts debit and credit cards, enabling businesses to expand their payment options and improve customer satisfaction.

Attractive Instant Commissions: Earn competitive, instant commissions with every ATM transaction processed through the Falcon® AEPS machine, adding extra revenue effortlessly.

Real-Time Fund Transfers: Enjoy immediate access to your earnings as the Falcon® AEPS machine transfers funds directly to your Biznext wallet, streamlining your cash flow along with commission earnings.

Integrated Printing Functionality: The built-in printer ensures you can provide printed receipts without the need for additional hardware, boosting operational efficiency.

Large Screen with Built-In Android: This AEPS machine comes equipped with a large display powered by Android, eliminating the need for an external phone or device for operation.

RD Registered Fingerprint Scanner: The Falcon® AEPS machine includes an integrated RD registered biometric scanner for secure, smooth AEPS transactions, enhancing safety and customer trust.

Technical specifications of Falcon® AEPS Machine with Bluetooth Micro ATM

| Technical Feature | Details |

| PRINTER TYPE | – 3″ thermal, 576 dots/line, 72mm printing area

– Four nos. of internal logo storage of 5kb each – Multilingual Text (English+Unicode) with 4 different fonts, 1D & 2D Barcode, Graphics |

| COMMUNICATION | – Bluetooth ver 2.1 and optional BLE 5.0

– USB Serial communication |

| RECHARGEABLE BATTERY | – 7.4V at 2200mAH |

| PHYSICAL PROPERTIES | – Dimensions: – 120 mm (L) x 100 mm (W) x 50 mm (H)

– Weight – 230 g |

| CERTIFICATIONS | – BIS, WPC, RoHS |

| ENVIRONMENT | – Humidity – 95% RH non condensing

– Enclosure – Ergonomic ABS + PC plastic body – Operating Temperature 0 C to 50 C |

| OS SUPPORTED | – Windows, Android |

| SDK AVAILABLE | – Java, .Net,

– Protocol – ESC Printer, Evolute Proprietary – Windows Printer Service – Android Printer Service |

| TEXT & BARCODE SUPPORT | – Multilingual Text (English + Unicode), 4 fonts, 1D & 2D Barcode, Graphics |

| APPLICATIONS | – On-the-go Ticketing, Kitchen Order Token, Retail Payments, eGovernance, etc. |

| DEVICE INDICATOR | – Device ON/OFF indication LED, Bluetooth LED, Charging Status LED |

| PORTS | – RS 232 Port, USB Port, DC Jack/Charging Port |

| THERMAL PRINTER | – Included |

Why Choose Evolute’s Falcon® AEPS Machine?

With 25 years of expertise in fintech innovation, Evolute FinTech Innovations has led financial inclusion and economic growth in over 60 countries through its indigenous hardware and software solutions. Their strong focus on cutting-edge technology and a skilled innovation team makes Evolute’s Falcon® AEPS machine a reliable choice for businesses looking to provide secure, cashless services while benefiting from attractive commission structures.

Falcon® AEPS machine offers seamless transactions, supporting cash withdrawals, balance checks, and Aadhaar-to-Aadhaar fund transfers. Featuring a built-in Android OS, a large screen, and an integrated RD registered biometric scanner for enhanced security, it eliminates the need for external devices. The inbuilt thermal printer ensures instant receipt printing, making it a smart investment that enhances operational efficiency and customer satisfaction.

Support and Maintenance Falcon® AEPS Machine?

Evolute offers exceptional support and maintenance services for their AEPS machines, ensuring minimal downtime and consistent performance. With a dedicated support team, businesses have access to expert assistance in all over India whenever needed. Regular software updates are provided to maintain optimal functionality and integrate new security features, keeping your AEPS machine up-to-date and compliant with industry standards.

In case of technical issues, Evolute’s responsive customer service team is ready to troubleshoot and provide quick solutions, minimizing operational interruptions. Comprehensive maintenance plans are available, covering preventive checks and hardware servicing, ensuring the AEPS machine remains in top working condition. This commitment to support and maintenance underscores Evolute’s focus on providing a seamless experience for its users.

Contact Us

Are you looking to elevate your operations with AEPS Micro-ATM Machine? Contact Evolute today for more information or to schedule a consultation. Let us guide you to the perfect thermal printing solution for your business.

Frequently Asked Questions on Falcon® AEPS machine (Aadhaar Enabled Payment System Machine)

What is an Aadhaar Enabled Payment System (AEPS) Machine?

An AEPS machine is a device that enables secure, cashless transactions using Aadhaar-linked accounts. It facilitates services like cash withdrawals, balance inquiries, and Aadhaar-to-Aadhaar fund transfers through biometric authentication, ensuring quick and seamless transactions.

What is the full form of AEPS Micro-ATM Machine?

The full form of AEPS Micro-ATM Machine is Aadhaar Enabled Payment System Micro Automated Teller Machine. It allows users to perform basic banking transactions using their Aadhaar number and biometric authentication.

What is AEPS in Banking?

AEPS in banking refers to the Aadhaar Enabled Payment System, which allows individuals to conduct financial transactions using their Aadhaar number. It facilitates cash withdrawals, balance checks, and other basic banking services without the need for traditional bank cards.

What is AEPS Payment?

AEPS payment refers to transactions made through the AEPS machine, where users authenticate payments via their Aadhaar number and biometric information. This system enables secure, instant payments and fund transfers without requiring debit or credit cards.

AEPS Micro-ATM Machine

The AEPS Micro-ATM Machine is a compact, portable device that allows users to perform financial transactions linked to their Aadhaar number. This machine supports services like cash withdrawals, balance checks, and fund transfers, providing easy access to banking services for both rural and urban areas.

What is AEPS in an ATM?

AEPS in ATM refers to the use of Aadhaar-based authentication for transactions at Automated Teller Machines (ATMs). By using the AEPS machine, customers can perform banking activities like withdrawing money or checking their balance using their Aadhaar number and biometric fingerprint.

What is the Charge of a Micro ATM?

The charges for Micro ATM services vary based on the service provider and transaction type. Generally, there are small fees for cash withdrawals and other banking services. However, the specific charge is typically determined by the agreement with the service provider.

What is the Cost of AEPS?

The cost of AEPS depends on the machine, the provider, and the services included. Typically, businesses incur setup costs for acquiring an AEPS machine and may also pay transaction fees for each completed transaction. Prices may vary based on features such as card compatibility and biometric scanning.

What is the AEPS Limit Per Month?

The AEPS limit per month can vary depending on the user’s bank and account type. However, as per regulations, the maximum transaction limit is generally capped at ₹50,000 per month for individuals using AEPS machines for Aadhaar-based transactions.

Is AEPS Chargeable?

Yes, AEPS services are typically chargeable. Transaction fees apply to services such as cash withdrawals, fund transfers, and balance inquiries, though these fees may vary depending on the financial institution or service provider.

How Do I Withdraw Money from AEPS?

To withdraw money using an AEPS machine, you need to provide your Aadhaar number and authenticate the transaction with your fingerprint. Once authenticated, you can withdraw cash from your linked bank account via the AEPS-enabled device.

How to Activate AEPS Online?

To activate AEPS online, you must link your Aadhaar number to your bank account. Visit your bank’s online portal or mobile banking app to complete the Aadhaar linking process. Once linked, you can use AEPS machines to conduct transactions using your Aadhaar number and biometric authentication