In the last few decades, POS mechanisms have progressed from cashiers at the outlet to do-it-yourself vault booths.

To buy, receive, return, and pay easily is what customers’ utmost needs are! Customers don’t want to wait in long queues for their turn to pay the bills. Ergo, with the growing demand, businesses are advancing towards multi-device POS machines. POS technology advancements have undoubtedly improved customer satisfaction. A POS swipe machine now enables customers to complete transactions within a blink of an eye.Surprising! Isn’t it?

A study suggests: In 2020, the POS terminal market was worth INR 24.47 billion. And, between 2021 and 2025, it is expected to grow at a Compound Annual Growth Rate (CAGR) of 13.29%. To sum up, it’s expected to hit INR 50.01 billion in 2025. [1] Albeit, fixed POS systems are in vogue, demands for mobile POS are also on the rise.

Thus, fixed and mobile POS systems will grow at a CAGR of 10.15% by 2027.

History and Future of POS

The POS system came into existence when American companies shifted their interest from barter practice to cash transactions. To keep track of their money, business owners need to track business purchases.’

As a result, Azel C. Hough incorporated all these transaction requirements into a single mechanism. Soon, the Cash Register became the primitive POS system. Since large businesses had to add the amounts from each register to keep their accounting, cash registers were not suitable for large businesses. They were in need of

something more advanced. Luckily, IBM introduced an authentic POS system in 1973.

It administered over 128 IBM cash registers. Comparatively, they became the first industrial application for P2P networks. Later, in 1986, Gene Mosher developed the initial touch-screen variant of the primary POS system.

Following that, Martin Goodwin and Bob Henry worked for six years to launch the first Windows-based POS system.

Moreover, the POS system evolved when it linked up with Cloud technology in 2000. And now, the POS system has been amalgamated with a variety of things, such as table management, payment cards, gift cards, and so on. The current trends make it clear that “contactless” POS systems are the way of the future. It will help businesses to operate both front-end and back-end operations, and customers will be able to enjoy more

personalized POS machines in the near future.

Now IRIS is poised to become the technology of the future. Delta ID, the company behind the development of ActiveIRIS for the Unique Identification Authority of India (UIDAI), is working to integrate the IRIS technology into POS terminals.

With the orientation of IRIS, POS systemization will be revolutionized, and the customer experience will be enhanced further. The POS terminals will scan the consumer’s iris to ease payments through Aadhaar. However, to enjoy this facility, customers’ bank accounts should be linked to their Aadhaar. And if the customer uses a credit card, an iris scan would be used for authentication on the POS terminals too.

Everything You Should Know About ‘Evolute UniPOS A5’

With its easy-to-use Smart Android POS terminal, Evolute UniPOS A5 is India’s No.1 certified Smart Android POS terminal. UniPOS A5 is designed with cutting-edge technology and a Research & Development facility certified by the Department of Scientific & Industrial Research, India.

UniPOS A5 has considerably more to offer its users than an ordinary POS swipe machine! Evolute UniPOS A5 includes features such as:

Multimodal biometric authentication, including Aadhaar

● Fingerprint

● IRIS

● Facial

● Voice

Printing solutions

Omni Channel payment acceptance, including wallets, UPI, universal card, NFC,and QR codes.

What Does UniPOS A5 Bring to the Table?

Business owners can easily keep an eye on their inventory management system with an android POS machine, like UniPOS A5. For business owners, UniPOS A5 offers more than just POS device applications. UniPOS A5 helps ease the process of supply chain management within an organization by keeping an eye on inventory management. Apart from that, they can accept payments within a few clicks. They can handle returns

and exchanges smoothly too. The UniPOS A5 Android machine offers a lot more than just that, and businesses can take full advantage of it.

In UniPOS A5 you can perform transactions using facial as well as voice recognition, making the process easier.

There is no need to worry about running out of battery life on this device. Its 7800mAh battery will last the whole day with minimal drain. In addition to Ports, Bluetooth, and Wi-Fi, different communication options are available.

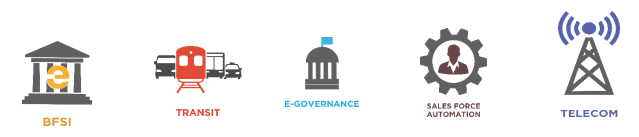

Segments that UniPOS A5 cater to

Due to its vast features, Evolute UniPOS A5 expertly serves several applications, which mainly revolve around:

How Can ‘Evolute Fintech Innovations’ Help You?

With its extensive array of products, services, and solutions, Evolute Fintech Innovations is dedicated to digitally empowering users. Evolute Fintech Innovations develops Android POS terminals for all types of money transactions. Our company provides all cashless payment channels with the latest security standards.

Banking, credit, information, and technological advancements that facilitate our clients’ needs are at the core of our client service. We, at Evolute Fintech Innovations, strive to make digital transactions breezier, swifter, and more versatile than ever. And not to mention, it all comes at an affordable price!

Contact us at sales@evolute-fintech.in today to learn how technology can empower